Insurance is an utterly essential part of living in the modern world. It guarantees peace of mind, leaving you safe in the knowledge that you’ll be compensated should the worst befall your home, your car or any of your most treasured possessions.

There are so many kinds of insurance out there it’s almost impossible to know what kind of policies you really shouldn’t be without – or it was, until we compiled the handy list below!

1) Building Insurance

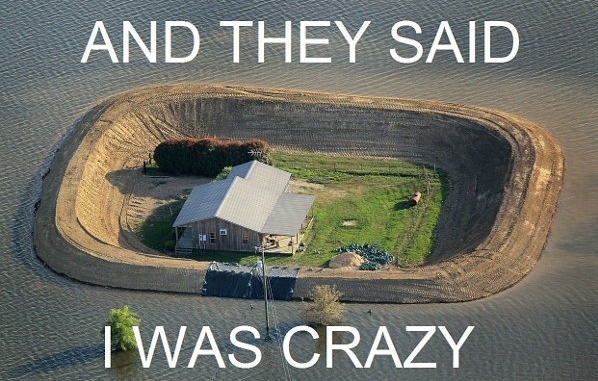

Building insurance is actually a legal requirement if you own your own home – it’s hard to get any more essential than that! Mortgage providers usually insist on you having a building insurance policy before they grant you a mortgage, with these policies being designed to cover you if your home is damaged by fire, floods, lightning or subsidence. In other words, anything that causes physical damage to the structure of the building.

2) Car Insurance

No surprise that car insurance makes an appearance! Again, it’s a legal requirement for all UK drivers to have at least third party cover if they want to be on the road. Most companies offer third party policies on the cheaper side of things (which cover passengers and damage to other people’s property) up to comprehensive cover (which covers any damage to your car too).

3) Contents Insurance

Contents insurance again applies to your home, but rather to your possessions as opposed to the actual building itself. Contents insurance covers you against loss, damage or theft of your possessions and, while it’s not a legal requirement, it’s really common to have a contents insurance policy. Usually, insurance policies will replace any items that are damaged or stolen, or they’ll pay the costs towards a like-for-like replacement.

4) Travel Insurance

Again, travel insurance isn’t a legal requirement, but it’s incredibly advisable to have a policy – even if you’re just taking a short trip. It protects you against sudden healthcare costs (which is particularly useful in countries without a national health service) and usually covers you against expenses incurred from cancellations to your journey, or against lost baggage. You can usually pick up a good policy at a low price, so it’s always worth bearing in mind before you head off on holiday!

5) Life Insurance

It’s not something anyone likes to think about, but life insurance gives vital peace of mind and protects against the day when you’re not around. If you’ve got dependent children who rely on your salary, life insurance ensures they’ll get either a large lump sum, or regular payments towards living costs if you pass away. Quite often, life insurance policies are reasonably priced (particularly if you’re young) and leave you secure in the knowledge that your loved ones will be secure, should the worst happen.